The start of a new year brings fresh opportunities, and for many, that includes buying a home. If you’ve been asking yourself, “Is 2025 the year I should buy?” then now is the time to be proactive. Taking these steps doesn’t mean you’re committed to buying this year, but it positions you to act confidently should the desire remain and the opportunity arise. Here’s how to evaluate your situation and take the first steps toward homeownership this year.

Why Consider Buying in 2025?

- Stability in the Market: Interest rates may fluctuate, but overall, 2025 presents significant opportunities for buyers as the market stabilizes. In 2024, Utah saw just over a 5% increase in its median sales price—a clear sign of market steadiness. Competition has tapered off, making now an ideal time to explore buying options. As interest rates begin to decrease, competition is likely to pick up, driving prices higher. It’s worth remembering that while interest rates can be refinanced to lower levels, home prices are fixed once you buy. Position yourself to benefit from current conditions before the market heats up again.

- More Options: With inventory expected to increase this spring, starting now ensures you’re ready to act when the right home hits the market.

- Wealth Building: Homeownership remains one of the best ways to build long-term equity and financial security. With pent up buyer demand at all time highs, there is no question why with higher interest rates we still saw a 5% increase in prices over 2024. Real estate is a solid investment and housing is a need, not a want.

Steps to Get Started

- Evaluate Your Budget: Start by using a personal financial statement to assess your income, expenses, and what you can comfortably afford for a monthly mortgage. Taking this step early in the year allows you time to address areas for improvement, such as boosting your credit score or saving more for a down payment. If you need assistance, reach out to us. We’ll provide you with our “Getting Ready: Personal Financial Statement & Personal Balance Sheet” worksheets. These tools simplify the process and help you feel more confident discussing your financial situation with loan officers as you move toward pre-approval.

- Get Pre-Approved for a Loan

A pre-approval not only clarifies your budget but also signals to sellers that you’re a serious buyer, giving you a competitive edge. If you need some recommendations, we can direct you to some top notch lenders who have been in the business for years, have great reputations, and will work in your best interests to secure a low rate for a great price. - Start Researching Neighborhoods

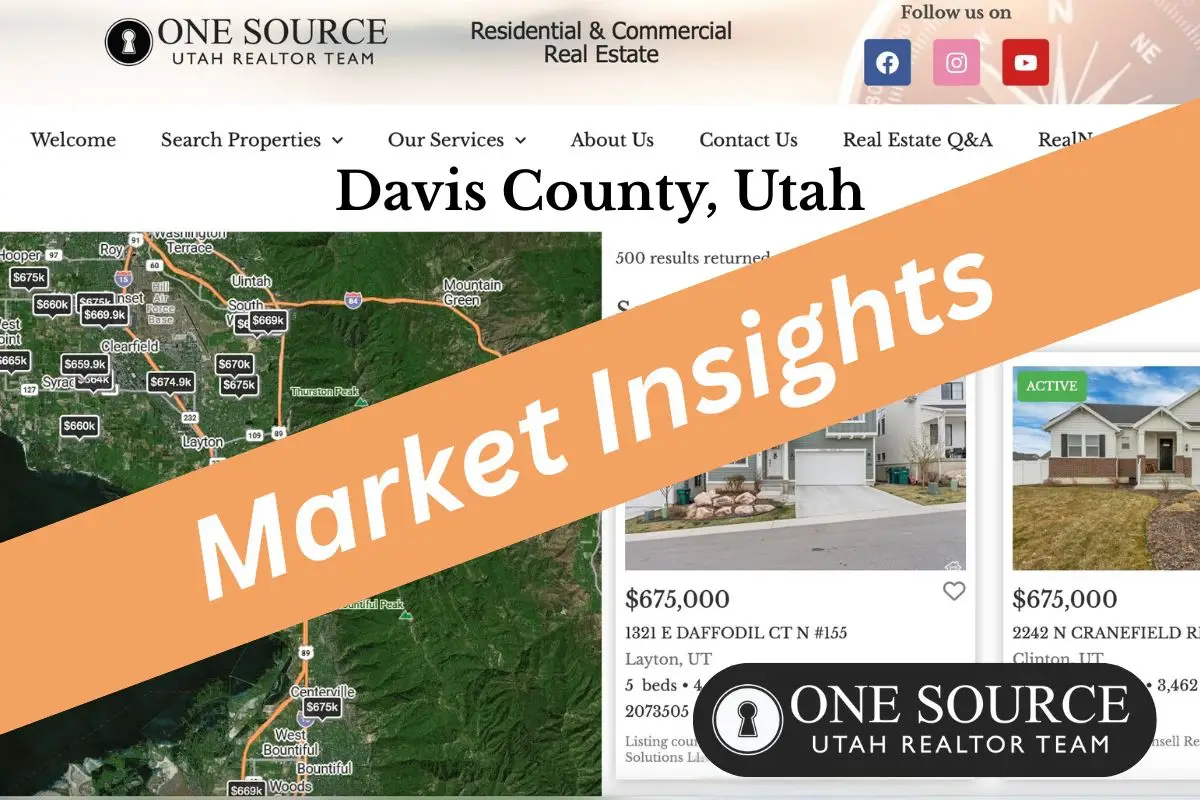

Explore communities that fit your lifestyle and goals. Look at schools, commute times, and amenities to narrow your search. Visit our website, OneSourceUtah.com to begin looking at all available home listed on the Wasatch Front Regional MLS. - Create a Wishlist

Identify your “must-haves” and “nice-to-haves” to focus your home search. This will save you time and help you find the perfect match.

Buyer Tip of the Month

“Timing is everything. By starting now, you’ll beat the spring rush and have more time to find a home that truly fits your needs.”

Ready to Start Your Journey?

Reach out today for personalized guidance and resources to help you buy your dream home in 2025. Whether you’re exploring options or ready to dive in, we’re here to make the process seamless.